The Chinese-American CPA Association (CACPAA)sponsored a CPE seminar on international tax law on August 22, 2020. The seminar was fully booked before it even started. The lecture was conducted by two experts on the following topics to help us serve our clients better.

Topic: Foreign Bank and Financial Account (FBAR) & Global Intangible Low-Taxes Income (GILTI)

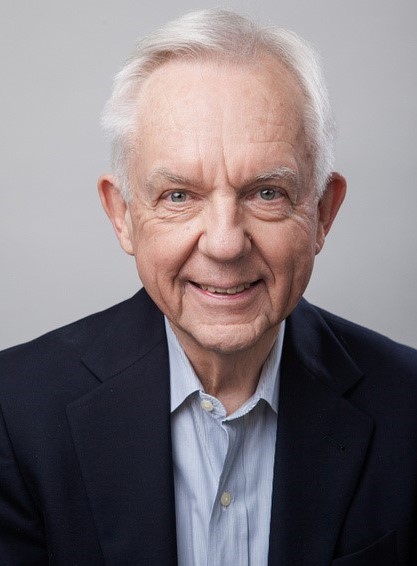

Attorney Rufus Rhoades has been involved in all aspects of federal and state income tax matters, including working with the IRS and the California Franchise Tax Board on various issues, as well as tax planning on various transactions. Rufus Rhoades graduated from Stanford University Law School. Rufus Rhoades is the co-author of Rhoades & Langer’s “United States International Taxation and Tax Treaties”, which is published by Matthew Bender, New York State. It has 6 volumes and is revised 4 times a year. His law firm is in a leading position in this field and covers all aspects of U.S. foreign taxation, including taxes on Americans operating in the United States, U.S. taxes on non-resident aliens and foreign companies, U.S. companies operating overseas, and U.S. foreign Analysis and reproduction of employees, foreign exchange transactions, foreign tax credit rules, transfer pricing, foreign restructuring, and all U.S. income tax treaties.

Mr. Rhoades focused on the update of the Report of Foreign Bank and Financial Account (FBAR) under the Bank Secrecy Act, and explained in detail the tax key points of Global Intangible Low-Taxes Income (GILTI). For more information on International Tax Law, visit: https://rufustaxlaw.com/

Topic: International Estate and Gift Planning

Squire Patton Boggs Principal

Attorney Dennis Huang is the principal of Squire Patton Boggs. Dennis specializes in real estate planning and management, international taxation and wealth management, family office structure, corporate inheritance, company formation, and charitable trust planning. He works with clients to protect their current assets and achieve peace of mind through personalized estate plans. His business consists of both domestic and international planning, helping non-American families develop plans and structures to pass their wealth to the next generation. He also helps families navigating the U.S. probate court system and manage trust plans when a loved one dies or becomes disabled. For more information on this topic, visit https://www.squirepattonboggs.com/en

CACPAA provided 2 hours of CPE credits to all the audience attending this lecture. If you are interested in this type of lecture, please contact us for notification of future events!

CACPAA Introduction

The members of the association not only possess solid professional knowledge but are also fluent bilinguals in Chinese and English. Many members are also very active celebrities in multiple communities in the Los Angeles region. CACPAA can be described as a diverse professional elite team.

CACPAA has organized several professional lectures and seminars to provide free tax services to the community. The association has also established good relationships with governments, chambers of commerce and accountants associations in other regions, allowing the outside world to learn more about Southern California’s professional talents, and also helping members to get in touch with more international projects, opening up another window to the outside world for Southern Californians. With the concerted efforts of professionals in various fields, CACPAA is playing an integral role in the increasingly frequent international trades, and it will surely become an indispensable bridge for communication between people from all around the world and people of the Southern California region of the United States.