This article is a translated reprint of:美新社

CACPAA Director of PR

On November 6th 2020, the Chinese American CPA Association and the US Small and Medium-sized Enterprise Administration (SBA) successfully held an online seminar on PPP loans.

CACPAA president Jeff Huang CPA, Vice Chairman Mary Lin , Secretary-General Chenny Huang, EA, and Founding Chairman Howard Li CPA, etc., welcome representatives from SBA Orange County and Inland Empire Branch, as well as over 100 members and community representatives, to attend the webinar.

CACPAA president Jeff Huang CPA first gave a welcoming speech and expressed the determination and dedication of the CACPAA, as a professional association that gathers more than 300 industry elites, to continue helping its members and the community by holding free lectures like this one.

CACPAA 会长

Due to the impact of the pandemic, this lecture once again was conducted in the form of an online video conference to facilitate members and the public; the topic covers the programs of the US Administration of Small and Medium Enterprises, especially the Paycheck Protection Program (PPP) loan and Economic Injury Disaster Loan (EIDL) loan service, and the update of international tax laws.

He also pointed out that the CACPAA will regularly launch large-scale professional lectures, and hopes everyone will continue to attend. Professionals from fields of accounting, legal, investment and financial management, insurance, real estate, education and other industries are also welcome to join the association and develop the community together. “Your success is also the success of the association.” He added.

Introduciton of Small Business Adminstration (SBA), Paycheck Protection Program (PPP), and Economic Injury Disaster Loan (EIDL)

Godfrey Hinds, Economic Development Commissioner from the Orange County and Inland Empire Branch of the SBA introduced:

The branch services approximately 7 million people in Orange County, San Bernardino County, and Riverside Counties. In 2019, there were 1721 loans totaling $11 billion, ranking fifth among 68 branches in the United States.

The SBA is not the direct issuer of loans but acts as a guarantor for businesses, enterprises, and entrepreneurs to apply for loans and obtain loans from local partners and lending institutions.

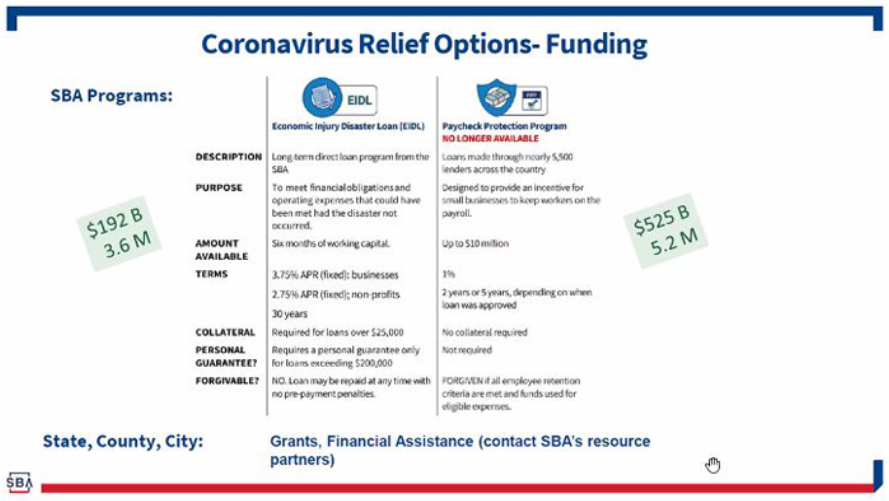

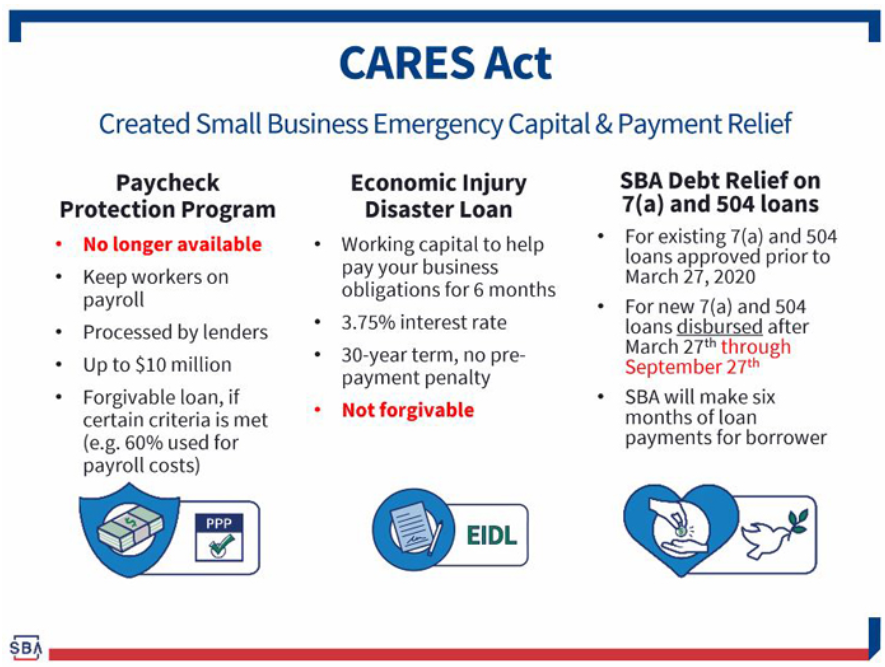

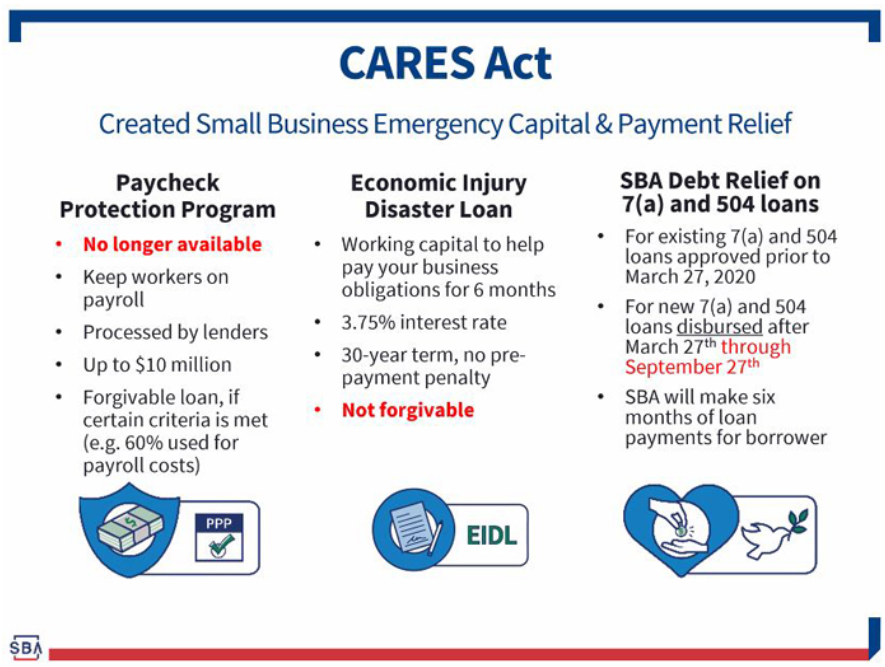

In response to the Covid-19, Congress had passed CARES ACT to grant a variety of loans, the most common and well-known of which are:

- Paychek Protection Program (PPP) loans, and Economic Injury Disaster Loans (EIDL)

- The biggest difference between the two is that the former can be exempted from repayment if the conditions are met; the latter must be repaid.

- There are also existing 7(a) and 504 loans that can be forgiven to a certain degree.

- The funds for the PPP loan and the EIDL loan have all been exhausted, and a new round of financial assistance bills are needed to continue the program.

Economic Injury Disaster Loan (EIDL) Update

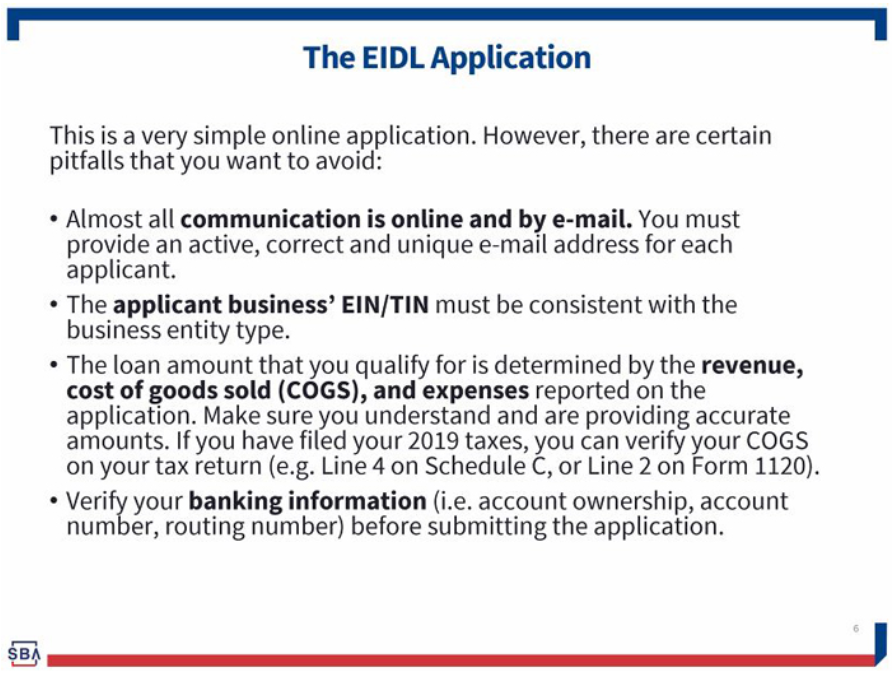

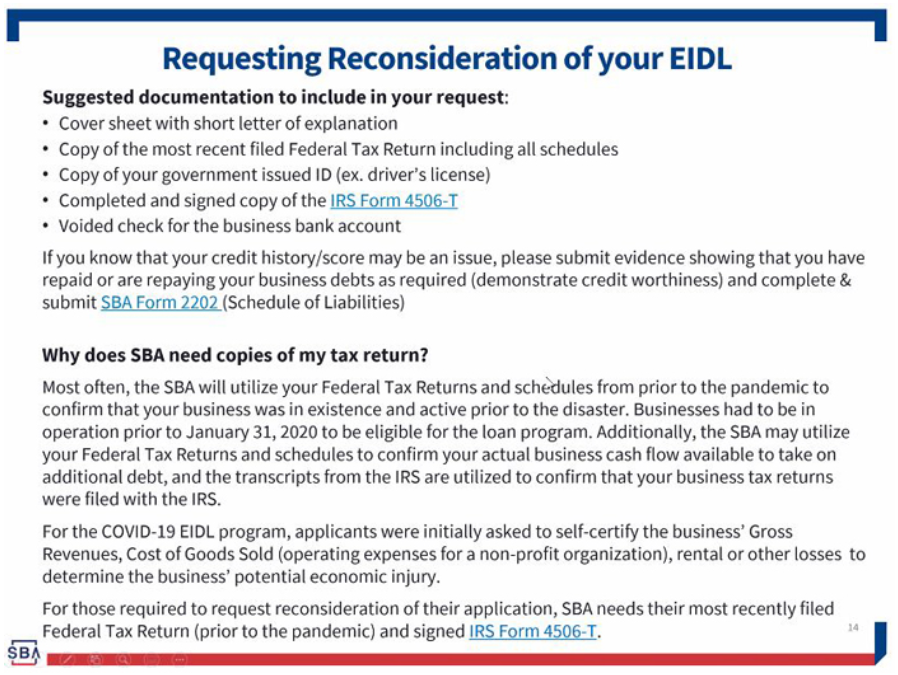

Lender Relations Specialist Ron Galati (Ron Galati) and Outreach & Marketing Specialist Adam Johns (Adam Johns) from the SBA Orange County and Inland Empire Branch also introduced the PPP loan forgiveness conditions, Loan application guidelines, and how to reapply after the application for EIDL is rejected.

For more detail, please visit:

- U.S. Small Business Administration

- U.S. Small Business Administration Orange County and Inland empire Branch

CACPAA Introduction

The members of the association not only possess solid professional knowledge but are also fluent bilinguals in Chinese and English. Many members are also very active celebrities in multiple communities in the Los Angeles region. CACPAA can be described as a diverse professional elite team.

CACPAA has organized several professional lectures and seminars to provide free tax services to the community. The association has also established good relationships with governments, chambers of commerce and accountants associations in other regions, allowing the outside world to learn more about Southern California’s professional talents, and also helping members to get in touch with more international projects, opening up another window to the outside world for Southern Californians. With the concerted efforts of professionals in various fields, CACPAA is playing an integral role in the increasingly frequent international trades, and it will surely become an indispensable bridge for communication between people from all around the world and people of the Southern California region of the United States.